Table of Contents

Have you ever found yourself scratching your head, bewildered by the complexities of payroll? You’re not alone. Payroll can feel like a giant puzzle, especially when things don’t go as planned. From miscalculated hours to delayed payments, there are many challenges. But fear not! We’re diving deep into the world of payroll issues, armed with solutions, smiles, and a sprinkle of humor. Ready to become a payroll problem-solving hero? Let’s roll up our sleeves and get started!

The Mystifying World of Payroll Calculations

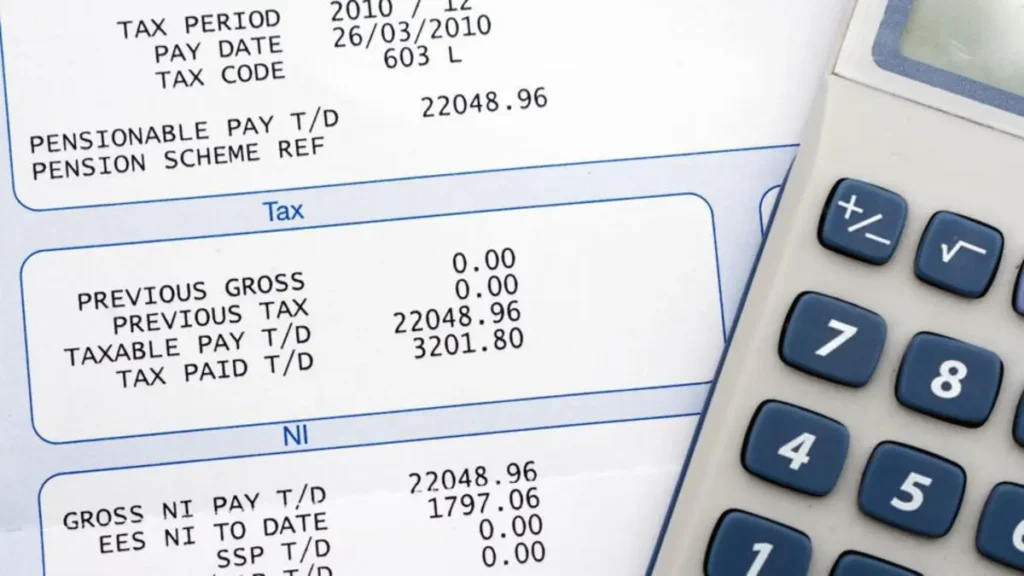

First off, let’s talk numbers. Calculating payroll seems straightforward until you’re knee-deep in tax codes, employee benefits, and overtime regulations. It’s like trying to solve a Rubik’s cube that changes colors every time you blink. The key? Stay informed and organized. Regularly update your knowledge of tax laws and regulations. Use payroll software to automate calculations. Trust me, it’s a lifesaver. This way, you can avoid those pesky calculation errors that can lead to unhappy campers in your team.

The Snail Mail of the Digital Era: Delayed Payments

Now, onto a biggie: delayed payments. Waiting for a paycheck can feel like waiting for rain in a drought. It’s frustrating and demotivating. Delays often stem from inefficient payroll processes or banking hiccups. The fix? Streamline your payroll process with automation and set clear timelines. Also, building a good relationship with your bank can make a world of difference. Remember, happy employees are those who get paid on time.

The Bermuda Triangle of Payroll: Lost Records

Ever feel like payroll records vanish into thin air? Welcome to the Bermuda Triangle of payroll issues. Keeping track of timesheets, tax documents, and pay records is crucial but can be daunting. Solution? Go digital. Use cloud-based payroll systems to store records securely. This way, you’ll never have to turn your office upside down looking for a lost document again.

The Twists and Turns of Tax Codes

Navigating tax codes is like trying to read a map with no landmarks. It’s easy to get lost. The twist? Tax laws change more often than fashion trends. The turn? It would help if you kept up. Regularly attending tax seminars and subscribing to tax law updates can be incredibly helpful. Knowledge is power, especially when it comes to deciphering the cryptic messages of tax codes.

The Juggling Act: Multistate Payroll Compliance

Managing payroll for employees in different states is like juggling flaming torches. Each state has its own set of rules, making compliance a hot topic. Dropping the ball can lead to penalties. The trick is to stay organized and informed. Consider hiring a payroll service provider who specializes in multistate operations. They can keep the torches in the air, so you don’t have to.

The Invisible Workers: Handling Freelancers and Contractors

Freelancers and contractors are the ninjas of the workforce; they come in, get the job done, and vanish without a trace. Paying them, however, shouldn’t be shrouded in mystery. Different rules apply to freelancers compared to full-time employees, especially when it comes to taxes. Clear contracts outlining payment terms and schedules can ensure clarity. And always, always keep a detailed record of all payments.

The Future is Now: Embracing Payroll Technology

Finally, let’s talk about embracing technology. Implementing a modern payroll system is like upgrading from a flip phone to a smartphone. The benefits are endless: efficiency, accuracy, and peace of mind, to name a few. Look for software that offers integration with time tracking and HR systems. It’s an investment that pays off by making your payroll headaches a thing of the past.

Wrapping It Up with a Bow

Navigating the labyrinth of payroll issues can be daunting, but with the right tools and a bit of know-how, it’s perfectly manageable. Remember, the goal is to ensure your team is happy and paid on time, every time. By staying informed, embracing technology, and keeping a sense of humor about the challenges, you can turn payroll processing from a headache into a breeze. So here’s to conquering the payroll puzzle, one piece at a time.

Read Also:-OFFSHORE