Table of Contents

Conventional Loan Let’s Break It Down

Have you ever found yourself at a fork in the road trying to decide which type of mortgage to pursue? Well, you’re not alone. Buying a home is a monumental decision, and the type of loan you choose plays a pivotal role in your financial landscape. So, why do so many borrowers lean towards a conventional loan? Let’s dive into the reasons that make it a standout choice.

Flexibility in Financing

One of the biggest advantages of conventional loans is their flexibility. Unlike government-backed loans that come with strict criteria and limitations, conventional loans offer a variety of terms and conditions. This means you can choose from different loan terms, such as 10, 15, 20, or 30 years, allowing you to tailor your loan according to your financial goals and needs. Whether you’re aiming to pay off your home quickly with higher monthly payments or prefer lower monthly payments over a longer term, conventional loans give you the liberty to choose.

Lower Private Mortgage Insurance (PMI)

Here’s something every homebuyer wants to hear: you can save money on private mortgage insurance. For conventional loans, PMI is typically cheaper than the mortgage insurance premiums required for FHA loans, especially if you have a good credit score. Moreover, PMI on a conventional loan can be dropped once you achieve 20% equity in your home. This is not the case with FHA loans, where mortgage insurance often remains for the life of the loan unless you refinance. Clearly, a conventional loan keeps more money in your pocket and less in ongoing insurance costs.

Higher Borrowing Limits

Are you eyeing a property in a particularly pricey market? Conventional loans might just be your best bet. These loans generally have higher borrowing limits compared to government-backed loans, which often cap the amount you can borrow. This higher limit is particularly beneficial if you’re looking at homes in competitive or high-cost areas. By providing access to larger amounts, conventional loans make it easier to purchase a home that meets all your needs without compromising due to financing limits.

More Property Types Eligible

Flexibility extends to the types of properties you can buy with a conventional loan. While some loan types have restrictions on the kind of property you can purchase, conventional loans are applicable to a wider variety of property types, including vacation homes and investment properties. This versatility makes it an ideal option for buyers looking to diversify their investments or enjoy a second home in their favorite getaway location.

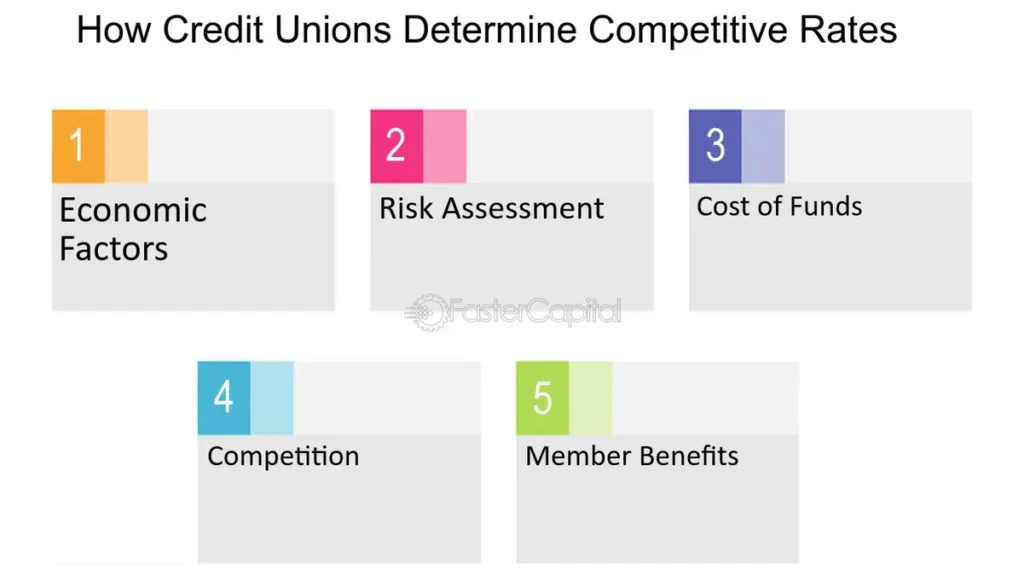

Competitive Interest Rates for Strong Credit

If you’ve got a solid credit score, conventional loans can offer another delightful perk: competitive interest rates. Generally, lenders provide lower interest rates to those with higher credit scores because they pose a lower risk of default. This means over the life of the loan, you could save thousands of dollars in interest payments, making a conventional loan not only an affordable choice but a wise financial decision as well.

Easier Asset Liquidation

In some cases, the requirements surrounding asset liquidation are less stringent with a conventional loan compared to government-backed loans. For instance, if you need to sell your home, there are fewer restrictions on how this can be done under a conventional loan agreement. This can be particularly advantageous if you need to move quickly or find a buyer in a short period. It adds a layer of convenience that can really take the stress out of selling your property.

Streamlined Refinancing Options

Thinking about refinancing in the future? Conventional loans offer streamlined refinancing options that can be easier and quicker to process than those for government-backed loans. This means if you want to take advantage of lower interest rates down the road, or if your financial situation changes, it’s generally more straightforward to refinance with a conventional loan. This flexibility can make a big difference in how effectively you can manage your mortgage in the long run.

A Path to Homeownership Your Way

Ultimately, choosing a conventional loan often means enjoying a smoother, more customizable path to homeownership. From the variety of properties you can buy to the potential for significant savings through lower PMI and interest rates, it’s clear why conventional loas remain a popular choice for many borrowers.

Choosing the right mortgage is as much about understanding your own financial situation as it is about the terms of the loan itself. If you value flexibility, potential cost savings, and control over your financing options, a conventional loan could very well be the best route to your new home.

Read Also:-MOUTH DENTAL IMPLANTS

Remember, the journey to homeownership is a significant one, and the type of mortgage you choose is a major piece of that journey. By opting for a conventional loan, you’re not just buying a house; you’re setting the stage for your financial future. So, weigh your options, consider your long-term goals, and decide if a conventional loa aligns with your vision of home sweet home.